What exactly is cryptocurrency and how does it work? Find out in our guide below.

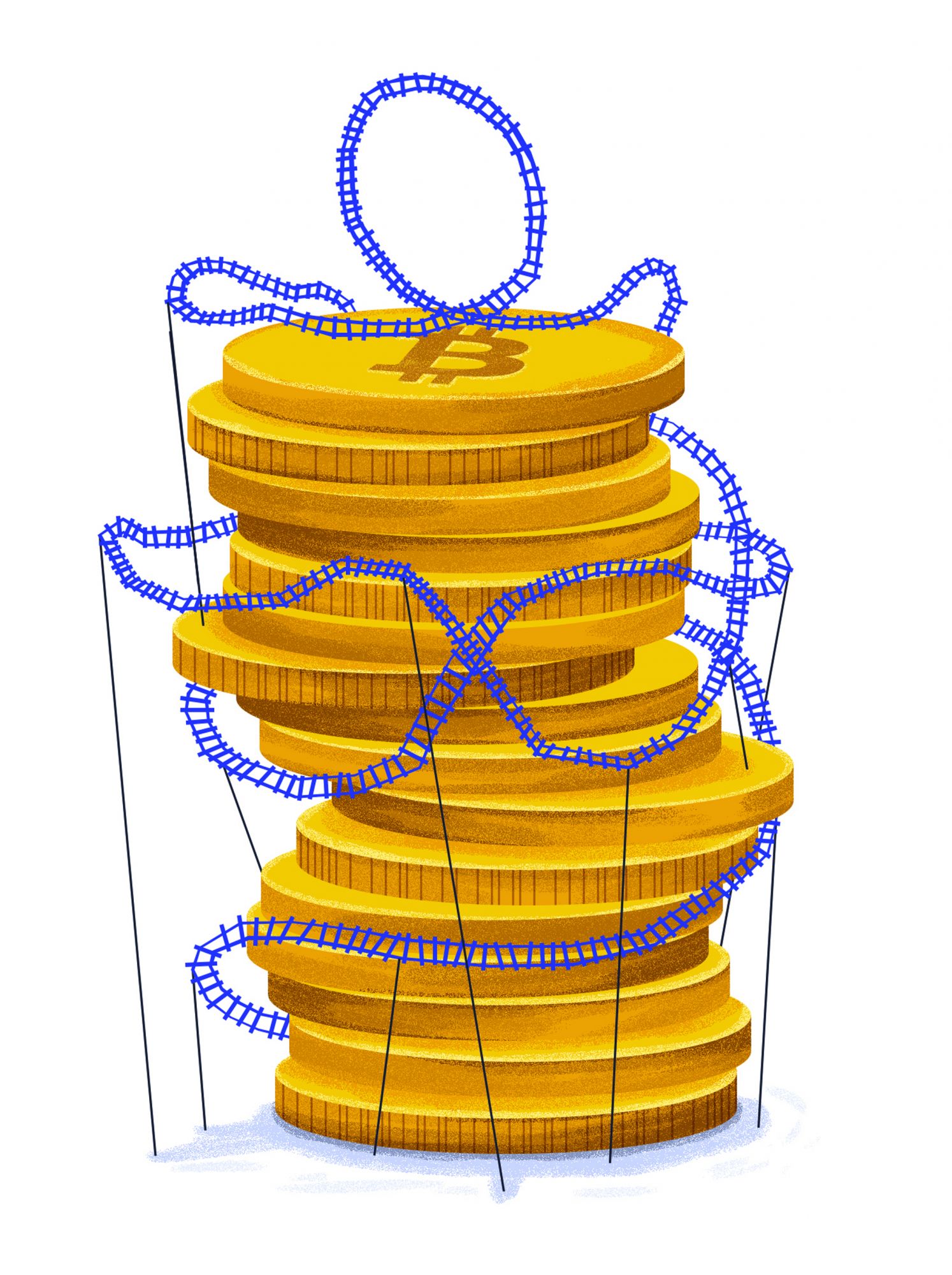

The value of a single bitcoin has risen by around 400 per cent this year, though exactly how much depends very much on which day you check. With such spectacular gains, high-net-worth individuals, institutional investors and investment banks are starting to take notice.

Mainstream interest in digital currencies isn’t entirely new. As the world becomes increasingly uncertain, many people are seeing bitcoin as a safe haven. Yes, it could be a bubble, but the growth of institutional flows is giving the market a more stable foundation.

“Bitcoin is the world’s biggest experiment,” says Dave Chapman, managing director of Octagon Strategy, a Hong Kong-based company that specialises in commodity and digital asset trading for high-net-worth investors and institutions. “But it’s less of an experiment than it was three years ago.”

What are cryptocurrencies?

Cryptocurrencies are digital currencies that use cryptography to secure transactions and the minting of new units of the currency. Bitcoin was the first to be created, when an anonymous individual known as Satoshi Nakamoto published the underlying technology in 2009. Many other cryptocurrencies have been introduced since then, but the general principle behind most of them is the creation of a decentralised digital currency that allows strangers to conduct anonymous transactions on the internet.

At the heart of these currencies is a secure database (such as the so-called blockchain that bitcoin uses, for example) that records and timestamps all transactions. This allows all parties to verify and validate a transaction—and by itself is a technology that has many potential applications in traditional financial services, such as money transfer or insurance or shipping, or basically anything that relies on accurate record-keeping between multiple parties. If you’ve ever been annoyed by the fact that it can still take days to transfer money internationally, blockchain might soon come to your rescue.

(Related: Productivity Apps Entrepreneurs Can't Live Without)