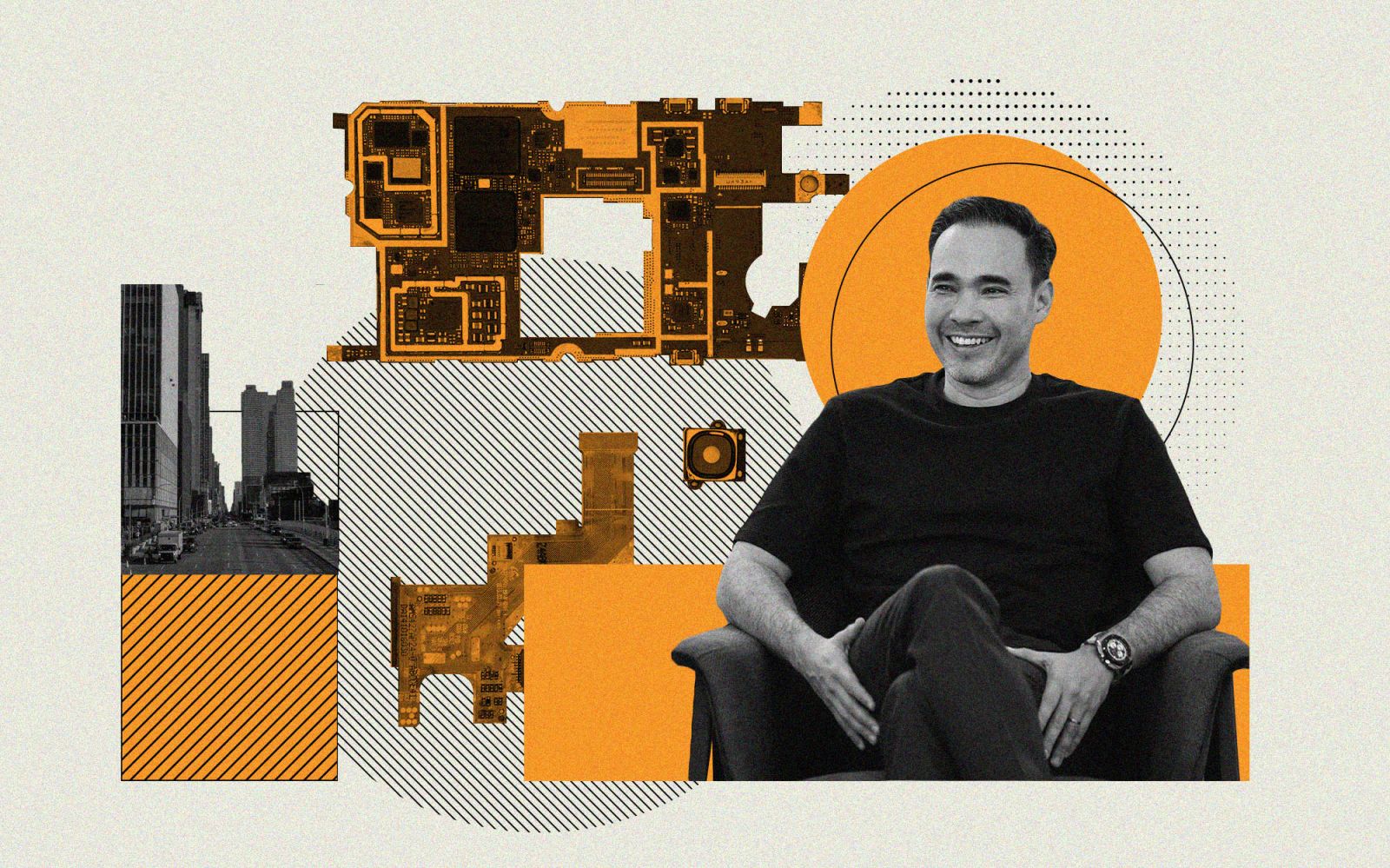

The serial tech entrepreneur and founder answers 10 quick questions

As one of Asia's most prolific tech entrepreneurs, Patrick Grove has seen the wild ups and downs of the industry over the past 25 years. Since his early arrival in the tech scene in 1999, Grove has founded multiple companies, survived the dotcom crash, and led six IPOs in Malaysia, Australia and the United States. And so, when Grove is asked to look into the future, he has an unmatched wealth of experience to draw upon when making bold predictions about the near future of business in Asia. This time, he's very clear about what the future holds: artificial intelligence, he says, has arrived—and everyone has to get on board very fast.

Read Patrick Grove's full profile on Asia's Most Influential

1. As an investor and an entrepreneur, what sectors, markets or ideas are you excited about?

I think AI (artificial intelligence) is one of the most fascinating technology developments in the last s months. Things like ChatGPT are just the beginning and already this technology is on the cusp of disrupting most journalism roles. The key is to be on the right side of technology, which is never easy.

2. Do you agree with the observation that tech in particular seems to have accelerated even more over the past few years? What ‘traditional’ industries are poised to be improved by technological innovations?

Technology growth is often exponential, which is why at the time we don’t seem to notice it, and then wake up three years later and its everywhere. I believe this is what will happen to AI. Technology is on the cusp of disrupting banking and healthcare, [which are] sectors traditionally still dominated by incumbents.

3. Is Asia ready for AI?

The world is not ready for AI—but it’s coming, so we better get ready. There is a possibility that 12 months from now, this entire magazine can be written by AI with only human involvement in editing and curating. There is a possibility that in 24 months, all magazines, websites and newspapers will be entirely produced by computers and software.

4. Are there any Asian companies are making interesting strides in AI, especially in the banking and healthcare sectors that you mentioned? Are you seeing any concrete opportunities for yourself in this space?

In China, yes; outside of China, nothing comes to mind! The Chinese are no longer copycats of Western technology, but often at the forefront of what is now possible. Look at Tiktok as a clear example of a Chinese algorithm outsmarting Facebook and Instagram.

5. Will Asian startups need to adopt AI tools or develop their own too to stay competitive?

Yes, companies that do not embrace AI in the next three years will be like companies today that don’t embrace digital. Basically, they won’t survive.

6. The pandemic has been foremost on our minds for so long. What developments or trends (in tech and beyond) should we be paying attention to as we move into the future?

AI is fascinating, but so is the movement away from globalisation, which actually creates more opportunities for local entrepreneurs. For too long, tech has been dominated by US—and increasingly China—giants.

In case you missed it: Patrick Grove is devoted to Southeast Asia as his brand, product and market